How Does Corporate Behavior Relate to a Nation's Soft Power

A dive into the relationship and correlation between corporate sustainability ratings and a nation’s soft power score.

As previously seen on the CSRHub blog

Does Corporate Behavior Relate to a Nation’s Soft Power?

We have compared data on nations’ soft power from Brand Finance’s Global Soft Power Index with their ESG (environment, social, governance) ratings from CSRHub. A number of soft power indicators correlate well with the views of the other sources available to CSRHub. We also compared the soft power scores with the aggregate ratings of the perceived ESG performance of companies in these countries. The correlation here was poor. We share several reasons why corporate sustainability ratings may relate to a nation’s soft power score.

Overview

Companies are a vital part of civil society. They create products, provide jobs, and pay taxes. Over the past ten years, a growing number of companies have made a commitment to enhance their long term sustainability by improving their environment, social, and governance (ESG) behavior.

Over this same period, governments have become increasingly aware that their nation’s success may be determined as much by their “soft power” as by their military strength. The concept of soft power was first introduced by Harvard Professor Joseph S. Nye. He argued that there is an alternative method of foreign policy for states to win the support of ‘the International’; rather than the traditional hard power method, which involves using coercion as the primary means of achieving its goals. As Professor Nye puts it: “A nation’s soft power can be measured by analyzing its general capacities and investments or Inputs, perception of its capabilities and actions or Equity, and its effectiveness in influencing actors in the international arena or Outputs.”

In February 2020, Brand Finance published its inaugural Global Soft Power Index – the world’s most comprehensive research study on the perceptions of soft power. It gathered responses from over 55,000 people in more than 100 countries, including a survey of the General Public in 87 countries with over 54,000 respondents. It complemented this work with a survey of over 1,000 experts from Specialist Audiences in 71 countries – academics, NGOs, government officials, business leaders, and media. Brand Finance has published scores on 30 soft power dimensions, ranking 60 nations.

CSRHub has been gathering data on corporate social behavior since 2008. CSRHub aggregates and harmonizes data from 700 sources in order to rate the ESG performance of 18,000 companies and provide ESG data on another 26,000 companies across 134 industries in 145 countries. CSRHub generates twelve subcategory ratings for each company it studies. A description of these subcategories and the elements that each covers can be found on CSRHub’s web site. CSRHub rates both public companies, private companies, not-for-profits and government entities (such as national governments).

CSRHub has ratings on the national governments of 59 of the 60 countries in Brand Finance’s Global Soft Power Index (CSRHub has no data still on Myanmar). CSRHub has ESG ratings on companies in 49 of the 60. CSRHub reports information on 35,875 companies that are headquartered in these 49 countries.

Study Methodology and Results

We first examined the correlation between each of Brand Finance’s 30 measures of nation soft power and CSRHub’s twelve subcategory measures of corporate social responsibility performance for each nation. In some cases, CSRHub did not have a value available. We excluded these missing pairs (the number of missing pairs was never greater than 20% of the total sample.)

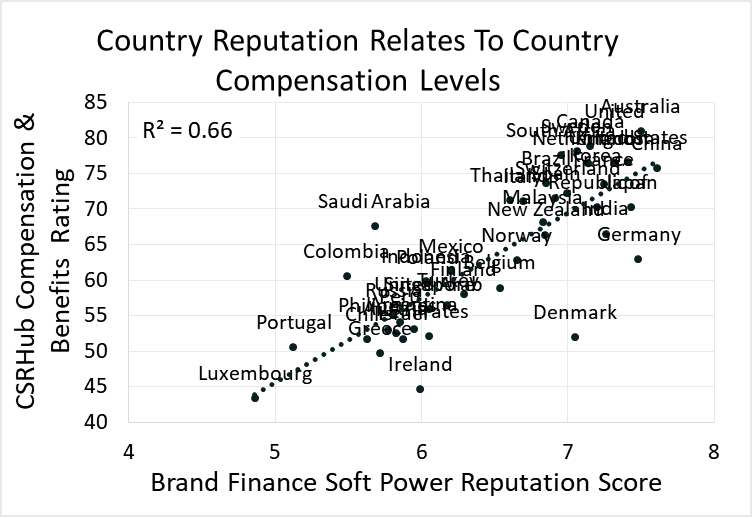

We found many significant correlations. Factors were considered significant if the probability that they were not equal to zero was greater than 95%. For instance, there was a strong relationship between a nation’s Reputation (as measured by Brand Finance) and its Compensation & Benefits rating (from CSRHub).

See Country Reputation Relates to Country Compensation Levels.

This correlation is similar to one we uncovered in 2013 between Brand Finance’s estimate of company brand strength and CSRHub’s measure of company compensation and benefits. We hypothesized in our previous study that paying a company’s staff well and giving them good benefits makes them better ambassadors for a company’s brand. This may be true for national governments, as well.

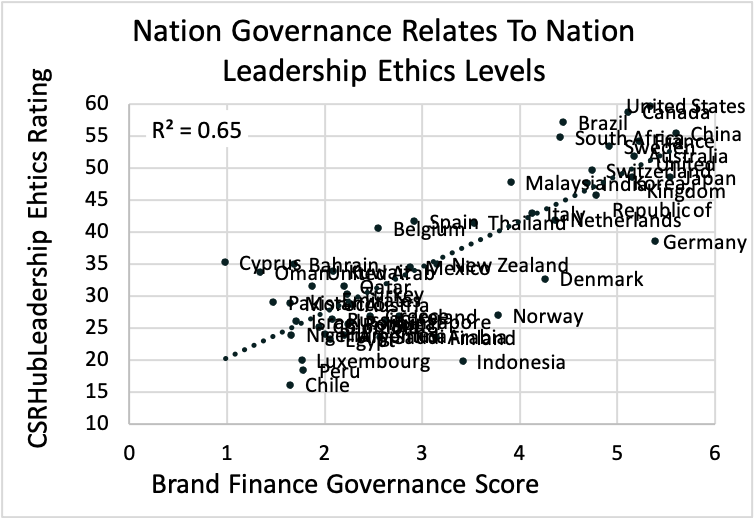

Another strong connection appeared between a nation’s Brand Finance Governance score and CSRHub’s Leadership Ethics rating. Most experts would probably expect that a nation that is thought to be well governed would be led by leaderships who are honest and ethical.

See Nation Governance Relates to Nation Leadership Ethics Levels.

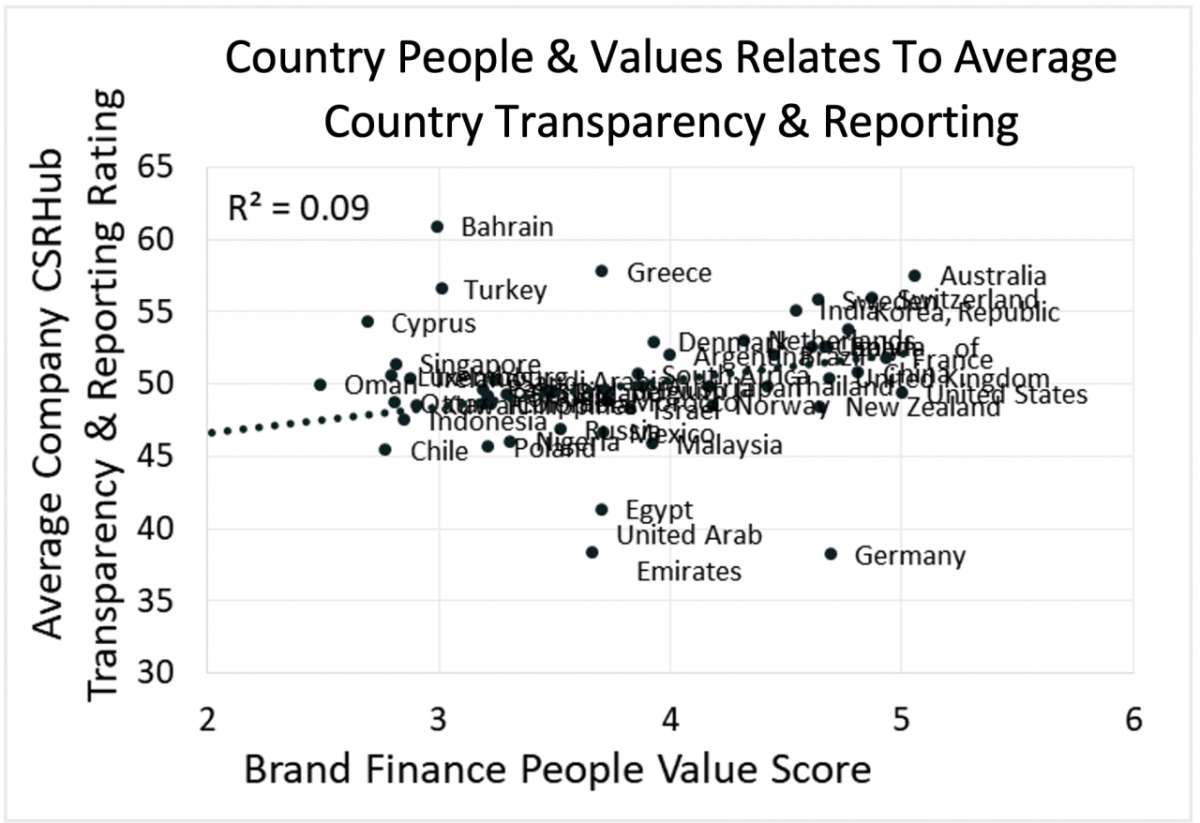

We next compared soft power factors for a nation against the average ratings of the companies they host. Company CSRHub Transparency & Reporting rating showed a connection to nation soft power. This rating measures the extent and quality of a company’s reporting of its own behavior. It seems that a nation’s companies can help or hurt it in areas such as International Relations, People & Values, and Business & Trade. See the modest correlation below for People & Values.

See Country People& Values Relates to Average Country Transparency & Reporting.

Discussion

Brand Finance’s soft power indicators seem to relate well to the views of other sources about national government ESG performance. These sources include groups such as:

- Glassdoor: A crowd source that gathers input from the people who work for an entity.

- Institutional Shareholder Services (ISS): A major Wall Street research firm that generates opinions on the social performance of a wide range of entities.

- Task Force for Climate Related Financial Disclosure: A not for profit organization that is attempting to improve the availability of data on climate risk.

- The World Bank: An international financial institution that provides money to the government of poorer countries and that collects statistical data on government activities.

As a result, we plan to integrate the Brand Finance soft power scores into CSRHub’s ratings of national governments and thereby improve the quality of our scores.

The poor connection between company performance and nation soft power may be due to one of several factors.

--Many large companies operate across multiple countries.

The majority of the entities that CSRHub tracks are public companies. These entities typically market their products and services in many countries. They have offices and factories outside of their home country and participate actively in other local economies too.

--A gap between our taxonomies.

Soft power is a concept that applies to nations (although some companies may also exercise it!). There may be a gap between a taxonomy that describes nation behavior and one that describes company behavior. We encountered a similar issue when we attempted to map the relatively mainstream categories within CSRHub’s data to the 17 goals set out for nations in the UN’s Sustainable Development Goals (SDGs). For instance, SDG Goal 14 calls for nations to “Conserve and sustainably use the oceans, seas, and marine resources for sustainable development.” Few companies can contribute to this goal and few ESG measurement systems would report on this topic.

--The best companies are those who report first.

ESG reporting and disclosure has tended to begin with the companies that have the best performance in this area. This is natural—companies are reluctant to share information about themselves that could hurt their reputation and draw criticism to their behavior. As a result, the average rating for the companies in a country starts high and then declines as more of the remaining companies start reporting their performance. Companies that are export-oriented or that have large foreign operations tend also to report before others. These companies are likely to conform to world standards in hiring, supply chain issues, governance policies, and environmental reporting.

The biases and limitation described above should gradually decline as more national governments and companies report more and better data on their ESG performance. However, even now our results suggest the national governments should consider the contribution that improving their own ESG performance could make to their soft power. They may also benefit by encouraging the companies in their country to follow policies that improve local social conditions and culture. We believe that the relationship we have described will become clearer and even better defined, in the future.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

CSRHub offers one of the world’s broadest and most consistent set of Environment, Social, and Governance (ESG) ratings, covering 20,000 companies. Its Big Data algorithm combines millions of data points on ESG performance from hundreds of sources, including leading ESG analyst raters, to produce consensus scores on all aspects of corporate social responsibility and sustainability. CSRHub ratings can be used to drive corporate, investor and consumer decisions. For more information, visit www.CSRHub.com. CSRHub is a B Corporation.