Regulatory Compliance for Corporate Philanthropy: Why, What, How?

Over the years, corporate philanthropy has evolved from a series of disconnected individual acts to a vital strategic component of a company’s corporate social responsibility (CSR) program… and has attracted increased regulatory scrutiny of the recipients of corporate largesse for links to international money laundering, organized crime, terrorism financing, financial mismanagement, fraud and related issues. Therefore, to avoid reputational risk and deeper legal/tax/financial infringements, companies must ensure full regulatory compliance and due diligence prior to the disbursement of funds or other forms of corporate giving, and can fortunately do so with technology-enabled vetting solutions.

Corporate Philanthropy Is Now a Strategically-Important Multi-Billion Dollar Industry

Companies now understand that well-channeled corporate giving enhances a company’s brand - in the eyes of employees, job seekers, customers and partners - and delivers significant tangible benefits such as higher employee morale and productivity, and improved customer and partner relations that carry through to top-line revenue growth, bottom-line profit and long-term share price appreciation. Moreover, today’s customers and consumers see social impact as a key differentiating factor in their purchasing decisions.

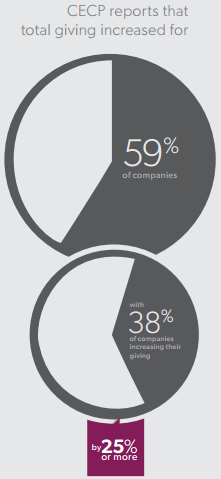

So, according to the Committee Encouraging Corporate Philanthropy (CECP), this awareness - of the benefits of corporate philanthropy – has resulted in a sharp increase in corporate giving. For example, of the 240 companies in CECP’s 2013 Corporate Giving survey, 59% reported an increase in giving from 2007 to 2012 and 38% reported an increase of 25% or more, with over $20 billion donated in total… some pretty significant growth numbers!

Corporate Philanthropy and Non-Profit Fraud Cross International Borders, Concern Regulators

Moreover, as technology and air travel make the world a smaller place, and as corporations increasingly operate across borders in growing economies, corporate philanthropy programs have evolved to address global issues such as disaster relief, humanitarian crises, health and education. As CECP’s 2013 survey confirms, companies that generated more than half of their total revenue outside the U.S. gave about 20% of their total corporate contributions to international programs to build brand and customer loyalty in new markets.

In parallel, rogue non-profits too have jumped borders in an increasingly global world and have become ever-more sophisticated in masking themselves – in the U.S. and abroad – with false fronts to collect cash and other forms of charity which they then misuse or misappropriate in creative ways. In response, regulatory organizations have stepped-up compliance requirements and put the onus on corporations to ensure legitimate giving.

Corporate Giving Programs Have to Step-Up Due Diligence and Compliance Against Fraud

So corporate philanthropy managers now need to be extra careful in verifying and screening charities to avoid damaging the company’s public reputation or risk legal/financial/tax ramifications that could cause deep collateral damage and discourage employees from future giving. For example, employees could be majorly put-off if they discover that donations they made for education were misappropriated to fund, say, terrorism or lavish rogue lifestyles.

In December 2013, the UK-based Charity Commission reported that fraud, financial abuse and financial mismanagement featured in almost 80% of its non-profit investigations in 2013, and warned that donations to aid refugees from civil wars were regularly rechanneled to support terrorist and extremist groups.

So corporate philanthropy programs now need to comply with a broad range of domestic and international rules enacted by the USA Patriot Act, the Office of Foreign Assets Control (OFAC), the U.K. Anti-Bribery Act, and other organizations – to ensure that charitable contributions accurately support legitimate causes.

Checklist to Ensure Globally Compliant and Legitimate Corporate Philanthropy

Charities must be screened against a matrix of relevant global laws, sanctions screening and watch lists. And, regardless of size or scope, all giving programs must stay current with cross-border money transfer declarations, tax filings and data privacy legislation.

So here’s a short checklist that corporate philanthropy program managers can use to ensure regulatory compliance before they select local and global non-profits:

- Is the non-profit or receiving organization a qualified charitable entity that can receive tax-deductible donations?

- In the U.S., is the charity a valid and current 501(c)(3) organization or equivalent?

- Has the non-profit been screened against a comprehensive and up-to-date sanctions database?

- Does your giving initiative meet local and international tax laws, filing requirements, etc.?

- Is there adequate security to protect the personal and financial data of employees participating in giving programs?

While all this may seem daunting, it isn’t something program managers have to do from scratch because there are corporate-philanthropy-focused technology platforms that address multiple aspects of corporate giving, including screening and verification, that make regulatory compliance and due diligence a breeze.