Fifth Third Bank Helps Customers Pay Down $5 Million in Student Loan Debt

Momentum app rounds up purchases to pay loans off faster

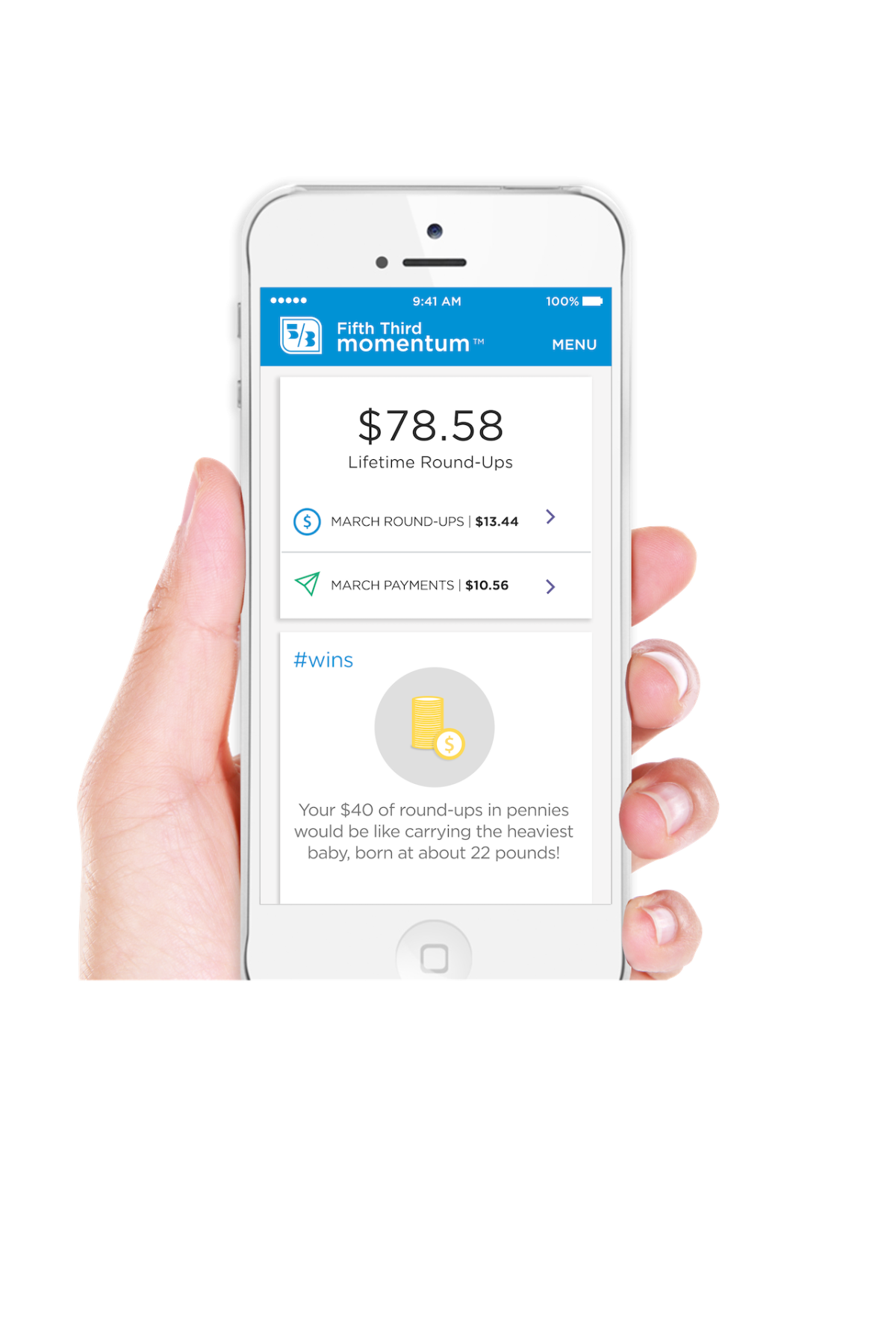

CINCINNATI, September 15, 2020 /3BL Media/ – Fifth Third Momentum™ recently hit a milestone: It now has helped customers pay down $5 million in student loan debt. The Fifth Third Momentum app, which launched three years ago, allows customers to round up their debit card purchases to apply to a student loan.

“We’re proud to play a role in helping families find solutions for student loans,” said Melissa Stevens, chief digital officer for Fifth Third Bank. “Even in times of hardship due to the pandemic, we want to help our customers continue to work toward a goal we know causes a lot of stress, especially for our Millennial customers.”

Fifth Third Momentum allows users either to round up debit card purchases to the next dollar or to add $1 to every purchase. The extra amount is then applied to the balance of a designated student loan. Payments are made on a weekly basis once a minimum of $5 is rounded up.

Fifth Third estimates that customers who round up $25 a month using the Fifth Third Momentum app could pay off 20-year loan three years sooner and pay 8 percent less in total by avoiding interest that would have accumulated.*

“Our customers tell us that they love how using the app is actually fun. They get badges as encouragement when they hit certain milestones or payments as they make extra payments toward their loans,” Stevens said. “We’re so happy to have helped our customers already pay down $5 million in student loan debt and look forward to many multiples of that number.”

Because student loan debt affects more people than just the borrower, Fifth Third Momentum allows graduates’ family members to use the free app, too. They can sign up with their own Fifth Third debit cards and connect their purchases to help their loved ones pay down their student debt.

Fifth Third Momentum is available to any Fifth Third debit card user and can be used with more than 30 major student-loan servicers – public and private. Because the app is easy to set up and doesn’t require much daily thought, the bank hopes the automated micropayments platform will make reducing debt something as easy and inexpensive day-to-day as buying a cup of coffee.

To get started, customers download the app (Android or iOS) and enter the name of the institution servicing the student loan. The app gives tips to help locate the loan number. Customers then decide on their preferences, including whether to round up purchases or contribute $1 for every debit-card transaction. Once $5 in payments is accumulated, the money is automatically sent to the student-loan account at the end of the week. To keep our customers motivated, they earn badges, called #Wins, for continuing to stick with this new habit.

Helping people towards their goals is a key tenet of Fifth Third’s digital strategy. In addition to Fifth Third Momentum, another free app created by the Bank, Dobot, helps its users reach short- and long-term savings goals. The app, which is available to customers and non-customers alike, automates savings, and sends tips and encouragement along the way. It helps users focus on what they are saving for and creates an easy path to get there.

For more information, visit 53.com/momentum or www.thedobotapp.com

* Example is based on a loan amount of about $37,000 – with a fixed interest rate of 6.80 percent.

About Fifth Third

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio and the indirect parent company of Fifth Third Bank, National Association, a federally chartered institution. As of June 30, 2020, Fifth Third had $203 billion in assets and operated 1,122 full-service banking centers and 2,456 ATMs with Fifth Third branding in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia and North Carolina. In total, Fifth Third provides its customers with access to approximately 53,000 fee-free ATMs across the United States. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending and Wealth & Asset Management. Fifth Third is among the largest money managers in the Midwest and, as of June 30, 2020, had $405 billion in assets under care, of which it managed $49 billion for individuals, corporations and not-for-profit organizations through its Trust and Registered Investment Advisory businesses. Investor information and press releases can be viewed at www.53.com. Fifth Third’s common stock is traded on the Nasdaq® Global Select Market under the symbol “FITB.” Fifth Third Bank was established in 1858. Deposit and Credit products are offered by Fifth Third Bank, National Association. Member FDIC.